Cyber Due Diligence

No company would acquire another without first conducting financial due diligence. Does it not, therefore, make sense to also conduct cyber due diligence?

As with other forms of transaction due diligence, cyber due diligence helps inform decision-making and negotiations

before an investment.

As the scale and frequency of cyberattacks continue to grow, the impacts of cyber security incidents reached an all time high in 2021.

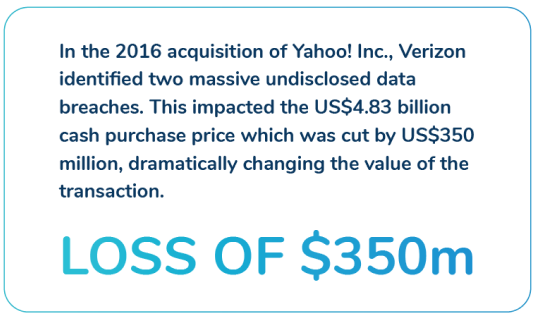

Breaches of sensitive personal data, theft of intellectual property (IP) and sensitive business information, and disruptive ransomware and distributed denial of service (DDoS) attacks can adversely impact companies’ financial results, share value, brand and trust among customers and clients.

As a result, the underlying value of acquisitions is affected by limited cyber security and data protection policies, hasty technology implementation and poor crisis management planning. All increasing points of focus for investors.

MANAGE RISKS

Controlling Risks’ insights, that could affect the value or brand and the potential cost of remediation, have supported our clients following the acquisition.

CYBER DUE DILIGENCE IN ACTON

Cyber Maturity Assessments were traditionally used by clients following a specific acquisition, or as part of portfolio risk management.

With the launch of Cyber Due Diligence, the process now begins pre-acquision; serving to inform of the value in advance, a cyber “health check” on investments, and a prioritised view of the cyber security maturity of portfolio companies.

Breaches trigger scrutiny of what steps have been taken before or after a deal. Conducting thorough checks of the cyber hygiene throughout the investment lifecycle help mitigate risks, should one occur.

CHALLENGES

CHALLENGES

- Investing into a company without the appropriate Cyber Due Diligence on the directors and business can lead to significant risk to the acquirer or investors.

- When an acquirer/ Investor buys into the business they Inherit the risks and the potential reputation damage. Security Review on the business including Penetration test and Cyber Risk Score.

- Dark Web investigation and analysis on the organisation

- Digital Footprint on Directors.

“Stay ahead of the

curve and protect both

value and brand.”

SOLUTION

- Investing into a company without the appropriate Cyber Due Diligence on the directors and business can lead to significant risk to the acquirer or investors.

- When an acquirer/ Investor buys into the business they Inherit the risks and the potential reputation damage. Security Review on the business including Penetration test and Cyber Risk Score.

- Dark Web investigation and analysis on the organisation

- Digital Footprint on Directors.

EXPERTISE

Controlling Risks’ insights, that could affect the value or brand and the potential cost of remediation, have supported our clients following the acquisition.

Traffic light report of the security vulnerabilities discovered about the organisation and directors

Cyber Due Diligence provides a complete overview into the company background and directors digital footprint providing assurance to the Investment team.

Review internal and external cybersecurity assessments.

Identify any gaps in your current security programme and objectively prioritise their closure.

A report outlining the maturity of the organisation and benchmarking against similar industries

Benchmark your security processes and performance against the metrics of a respected industry standard to demonstrate value and on-going improvement to stakeholders.

Digital Human Reconnaissance on all the Directors

Insight into stakeholder’s potential risk: Identifying if any organisations critical stakeholders have been compromised.

CYBER DUE DILIGENCE

The need to effectively assess risk, manage and resolve cyber events – at pace – has never been greater.

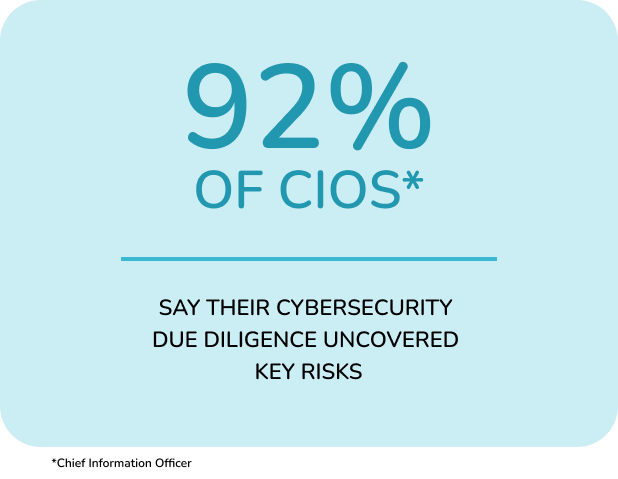

As cyber threats are here to stay, it will be critical for investment teams to systematically assess the cyber exposures associated with an investment, to protect value and mitigate reputational and regulatory risks.

Our dedicated CyberQ Group experts provide meaningful information to manage and reduce the risk of vulnerabilities exposed. Your Cyber Security partner protecting your brand, reputation, and data.

“In our experience, cyber due diligence is a vital tool for all. From investors, strengthening the value, through to security personal, investigating an incident and then building back better.”

Chris Woods

Chief Executive Officer

As per the requirements of ‘The Company, Limited Liability Partnership and Business (Names and Trading Disclosures) Regulations 2015’ the publication will need to contain the company’s full registered name. You could add this to the back page along with the company’s registration number and office address. This additional recommendation is not mandatory, however I don’t see a reason why you wouldn’t want to include the company registration number and office address.